Glad you asked. Actually, a FB buddy, John Ingraham Berry said, and asked:

Burdensome on those families and individuals who have very little… have a little trouble grasping and seeing the fairness of this concept.

It’s really very easy, especially on the poor. Once you understand what’s in the bill, it’s like a ‘slap yourself in the head’ brilliant concept. For lack of any media excitement or mediocre coverage of the FairTax, getting people to learn what’s in the bill, as opposed to what the establishment says about it, which is pure demagoguery, is the biggest challenge.

Under every circumstance EXCEPT the FairTax, a consumption tax is regressive. By percentage of income, it hurts the poor the worst. The FairTax doesn’t do that. It is progressive in a way that benefits the poor the most, as you will see below.

Here’s the short version.

1.) Everything everyone (poor included) buys today is paying all the income and corporate tax, capital gains, gift, estate, alternative minimum, SS and Unemployment tax, and self-employment tax of everyone involved in bringing that item to market, from raw materials, to manufacturing, to transportation, and all the costs of a wholesaler and retailer to bring the item to you, the final consumer. Call that the “embedded” tax. Everyone pays it, it’s in the cost of the item. It just isn’t itemized on your receipt. It’s hidden in that way, but it is there. Under the FairTax, the amount of federal tax you pay will be printed on your receipt. Totally transparent.

Now imagine what the same item would cost if there were no embedded taxes, if that product could be made with none of the above taxes. After over $22 million of research, the percentage amounts to about 22 % less.

The research included, of course, finding out what people buy at all income levels. No small task. That done, for the FairTax to be ‘revenue neutral,’ the FairTax percentage comes in at 23%.

That doesn’t mean an item automatically costs 23% more under the FairTax than it does today. When you remove the 22% embedded tax, and replace it with a 23% sales tax, you see a 1% increase in price on a widget. This is an average, not an absolute. One method is swapped with the other, having a negligible effect on cost to consumer.

2.) Here’s what the critics don’t tell you, or don’t know about. There is NO TAX on used items, including a car, motorcycle, boat, or house sold that was not bought by the ORIGINAL owner. The sales tax is ONLY for NEW items purchased for the FIRST TIME. Fair thing is, this applies the same to everyone, at all income levels. Including tourists, diplomats and other non-citizens.

3.) Because it is a consumption tax, assessed to new items sold, everyone pays it. The tax base instantly expands to 320,000,000 people instead of only legal citizens who have a job. What we have now is an income tax. No income = no tax revenue. And a tax base less than half of that. And because of that dynamic, the FairTax is a more stable revenue source. Fair thing is, this applies the same to everyone, at all income levels. Including foreign tourists, diplomats and other non-citizens, legal or illegal. And that tax never exceeds 23%.

4.) This is the part that makes this consumption tax progressive, instead of regressive. The Prebate. Designed to be the same, aka fair. Everyone gets this prebate based on the number of people in the household. And the prebate is for legal U.S. citizens only.

Now a new term to learn, effective tax rate. Based on the consumer spending research mentioned above, the amount of the prebate is figured to offset the sales taxes that would be paid for the basic necessities that everyone buys up to the poverty level as determined by HHS. It is paid to the household every month. Taking the prebate into account, lower income people pay less than 23%. In fact, the prebate at the lowest income levels make the effective tax rate a negative number. An income stream.

5.) Absent all the embedded taxes, at the federal level, the term ‘take home pay’ becomes obsolete. Your gross pay is also your net pay. THAT makes a big difference for all people, especially the poor. Currently, for every job, and many people do have 2 or more jobs, they pay those embedded taxes. Can’t get more regressive than that. Imagine the effect when they are not taxed every time they get another job. Purchasing power goes up for everyone, only greater for the poor. The rich pay the maximum 23%. But since “the rich” also buy more, they pay more taxes in dollars, obviously, than the poor, when they buy their yachts, cars, planes and other high-end toys. That’s how it affects families of all income levels, on the personal level.

6.) No more income taxes to file. And because of that, there is no compliance cost incurred to pay them. No tax preparers, accountants, or tax lawyers to pay. In total, a saving of over $400 billion. And, the IRS is effectively gone.

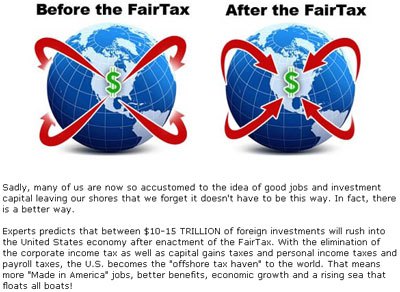

7.) On the national, macro level, absent the income tax, the $10-15 trillion that U.S. companies have sheltered overseas will come back to be invested here, since there will not be a tax obligation to shelter it from. Then, with the absence of an income tax, foreign business will come here and open up shop. The U.S. will become a global magnet for businesses. The U.S. will become the “offshore tax haven.” There will be a job for anyone who wants to work. Maybe more jobs than people. And competition between employers to get employees will do what? Increase wages. We will experience real economic growth on a personal and national level. And none of it government subsidized, adding to the national debt.

How the politicians spend that is another matter. The FairTax is only to be the replacement source for funding the government. It has nothing to do with how that money is spent or where it is allocated.

You can read the text of the bill HERE. It’s not 75,000 pages like the current IRS code. H.R. 25 is a whopping 132 pages long. And more information is available at the link at the upper right-hand corner of your screen.

Link: H.R. 25: FairTax Act of 2017