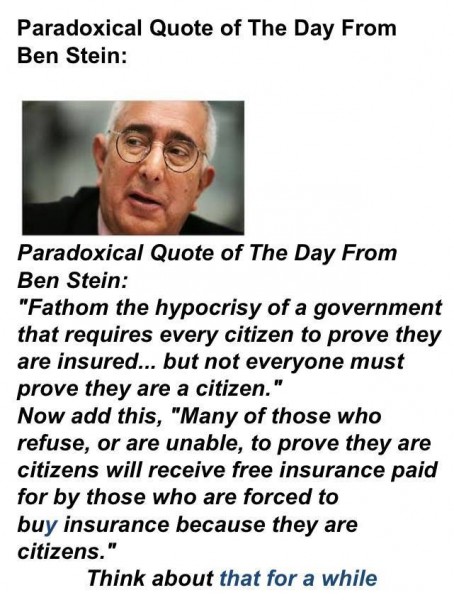

Where President Clinton built wealth-spreading into the tax code, President Obama put it into overdrive by adding “social justice” to it with the addition of the non-affordable Affordable Care Act. A nationalized health care scheme that requires the young and healthy to pay for the old and infirm. The consequences are surprising, and getting worse.

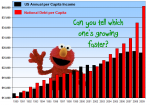

In a random act of journalism, CNBC reporter Jane Wells gives the striking details of a CBO report released last week entitled The Distribution of Household Income and Federal Taxes, 2010. (Table 3, Page 13) In personal income taxes it boils down to this, the rich don’t pay most taxes, they pay ALL the taxes. The upper two quintiles, or 40% of taxpayers, pay 106% of all personal income taxes. For the lower 40%, their “taxes” are a revenue stream.

Politicians are pretty slick when it comes to manipulating the tax code. Which is why we must get rid of it and replace it with something that can’t be used as a tool for class warfare and social engineering. The FairTax is the best alternative, for everybody. But I digress.

Remember the Taxpayer Relief Act of 1997? The tax code becomes a vehicle for spending programs.

Wielding the tax hammer for social engineering increases public debt. Lesson not learned here is that money doesn’t grow on trees and, stop increasing the spending. But it’s OK if you can use the tax code to buy votes. What? This is where the class envy/class warfare tactic, as connected to the tax code, was taken to a higher level.

The Taxpayer Relief Act of 1997 made additional changes to the tax code providing a modest tax cut. The centerpiece of the 1997 Act was a significant new tax benefit to certain families with children through the Per Child Tax credit. The truly significant feature of this tax relief, however, was that the credit was refundable for many lower-income families. That is, in many cases the family paid a “negative” income tax, or received a credit in excess of their pre-credit tax liability. Though the tax system had provided for individual tax credits before, such as the Earned Income Tax credit, the Per Child Tax credit began a new trend in federal tax policy. Previously tax relief was generally given in the form of lower tax rates or increased deductions or exemptions. The 1997 Act really launched the modern proliferation of individual tax credits and especially refundable credits that are in essence spending programs operating through the tax system.

“There’s no difference at all in terms of the effects on the federal deficit,” says Roberton Williams of the Tax Policy Center. “It’s perfectly equivalent. It’s just easier to say, ‘I cut your taxes’ as opposed to ‘I created a new federal program to send money to people.’”

Links: The rich do not pay the most taxes, they pay ALL the taxes | Happy Tax-The-Rich Day

policies being cancelled, affecting three times that many people, Obama’s humbling and gratuitous

policies being cancelled, affecting three times that many people, Obama’s humbling and gratuitous